Benefits of Pradhan Mantri Awas Yojana.

It aims at Slum rehabilitation

The PMAY scheme is a well thought out scheme that ultimately profits the economy and the country. The basic function of this plan is to eliminate the slum houses and replace them with ‘concrete or pucca homes, especially from the urban cities of India that greatly contribute to the GDP.

It provides housing for all

One of the good advantage of PMAY is that it aims at provides permanent housing for all. Under this scheme, the government is willing to construct as many as 2 crore affordable 1 BHK flats in few of countrys prominent urban areas. House construction has already started in the States of West Bengal, Tamil Nadu, and Maharashtra etc. The Government of India goal is to risen up the common standard of living of the Indian population and remove poverty through these houses.

Contents

It encourages budget housing for all sections of society

The PMAY scheme aims to offer inexpensive housing to all sections of society. These profits are extended to customers who do not own any house and fall within specific sections of society and income groups. Applicants are divided into various groups such as middle income groups (MIG), economically weaker sections of society (EWS), and lower income groups (LIG). Additionally, it also encompasses minorities such as members of scheduled tribes, scheduled castes, other backward classes as well as senior citizen applicants and women, members of transgender communities and widows.

It secures the financial future of women

Another great benefit of PMAY is that it motivates women to apply for loans and become home-owners. As per the scheme, there are numerous beneficial things done to protect the financial future of women, especially when they are widowed and older.

The benefit of eco-friendly housing

Developers and builders in charge of constructing homes under the PMAY Scheme, have been instructed to construct the homes with eco-friendly technology and construction material. The goal behind this is to certain minimum damage on the environment around the construction site, including damage causes due to sound and air pollution. Homes are being built with good quality material to delete the requirement for renovation or remodelling for as long as possible.

What is the IAY Scheme?

In the plainest term, IAY/PMAYG is a exclusive housing plan, do offer comfortable economical housing to homeless people or to family members living in kutcha houses. The state Government, with support from central governments, sponsors the building of living units or pucca houses. These homes are then given to the beneficiaries of this scheme, along with numerous other benefits.

Each such house must be provided with the good living condition blend with all sanitary amenities. Moreover, construction is carried out using eco-friendly procedures and material.

What is the Indira Awas Yojana Scheme and why was it Renamed PMAY?

IAY evolved over the years and at present equal in scope to PMAY Gramin scheme benefits, its offering, benefits, and services are effective under the PMAY. After proper assessment, in April 2016, Indira Awas Yojana was redesign under Pradhan Mantri Awas Yojana Gramin scheme, just a year after PMAY was launched by the Indian Government.

Key Features of Indira Awas Yojana

⦁ All constructed houses under this IAY should measure at least 25 square metres.

⦁ Along with each unit, beneficiaries shall receive Rs.1.30 lakh as assistance in hilly regions and Rs.1.20 lakh as financial assistance in plain areas.

⦁ Under the MNREGA scheme, Beneficiaries do also find employment for 90/95 days.

⦁ Under the Census of 2011, Residents of only the recognised statutory cities do claim benefits.

How to Apply for Indira Gandhi Awas Yojana?

The IGAY does not have an application procedure as such. Names of beneficiaries are forwarded and chosen to the respective authorities by the Gram Sabha. Still, registration under the scheme is attainable, using the following process –

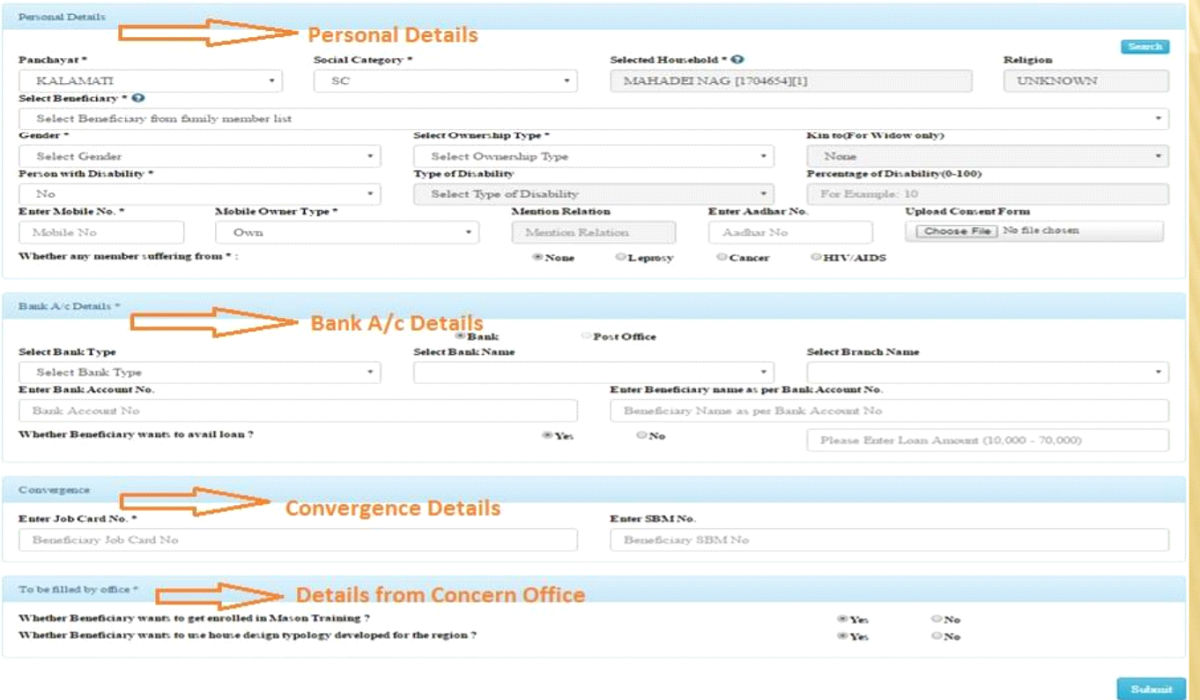

⦁ Step 1: Go through the official PMAYG portal.

⦁ Step 2: Do enter required details.

⦁ Step 3: Give Aadhaar number and click ‘Search’.

⦁ Step 4: Explore your name and click on ‘Select to Register’.

⦁ Step 5: Do enter all other information and upload a consent form.

⦁ Step 6: Do enter your savings account details.

⦁ Step 7: When availing a loan, click on ‘Yes’ in the next page and select the desired principal.

⦁ Step 8: Enter SBMG and MGNREGA number to complete registration procedure.

IAY benefits are easy to assess and understand. It can aid homeless people to attain a comfortable house for their families.

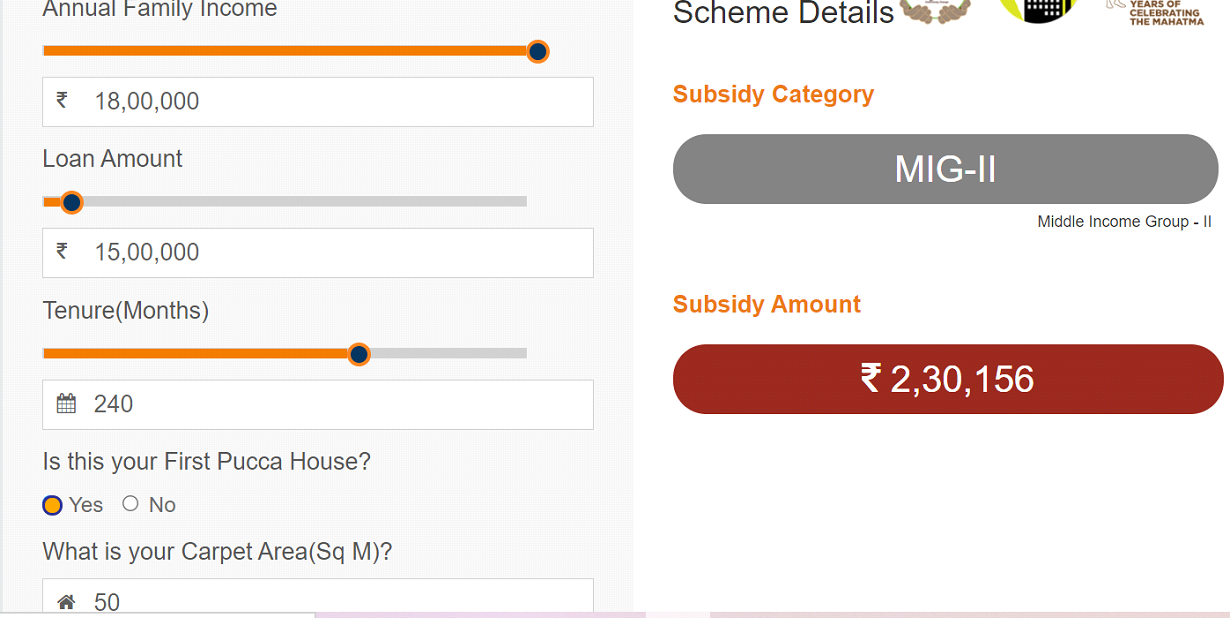

PMAY CALCULATOR

Who is eligible for PMAY?

Any household with an annual income between Rs 18 lakh to Rs 3 lakh do apply under this scheme.

The user or any other family person should not now own a pucca house in any chunk of the country.

The beneficiary cannot avail PMAY profits on the already built house.

For differently disabled and senior citizens, ground floor housing is given liking.

If the user is married, conjunction in joint ownership or either of the spouses do get a single subsidy.

How to apply for this PMAY Scheme 2021-22?

PMAY online Form 2021 is present on the official website of PMAY.

PMAY last date to apply is march 31,2022.

Under the credit linked subsidy scheme, The final date for applying was march 31,2021.

The PMAY scheme is only applicable for applicants with an aadhar card.

The eligible users do apply for online awas yojana form under the classification BENEFIT UNDER OTHER 3 COMPONENTS and FOR SLUM DWELLERS.

Q. In case of low income groups or weaker economically class what are the exceptions made for female ownership?

One adult female membership is now compulsory in property ownership. A property must be co-owned by a female person of the family. However, this treatment will not be given compulsory in scenario of building of home on an existing plot or renovation /extension of existing Semi-pucca /kuccha home.

Q. What is the definition of beneficiary family in case of MIGS or LIG or EWS?

The answer to this question can be categorized into three parts and they are as given:

⦁ In case of Lower Income Groups(LIGs) and Economically Weaker Section(EWS), the unmarried children, husband and wife is considered as the household or beneficiary family.

⦁ In case of Middle Income Group(MIG), unmarried children, husband, and wife are considered.

⦁ An earning adult member of the sweet home will be regarded as a separate earning person and would not be counted a beneficiary to the family.

Q. What is the required documentation?

Under the IIHFL Credit policy, the following has to be submitted as paper work in case of applying for this yojana:

⦁ Aadhar card of all sweet home people without which you are not applicable to apply for the PMAY ⦁ home loan.

⦁ the document for Undertaking or Notarized affidavit is mandatory.

Q. May users having ownership of a land or pucca house do apply for credit linked subsidy?

You are not eligible to apply for credit linked subsidy in the scenario you own a pucca house anywhere in the nation. However, this is not the only boundary to be applicable for the subsidy, other factors such as property in urban localities, household annual income, etc. are also taken into reflection before approval for subsidy is passed.

Q. How is subsidy amount fixed and set? Is the loan amount to be reduced or the tenure?

On basis of PMAY categories as Subsidy amount is fixed.

⦁ Lower Income Group(LIG) and Economically Weaker Section(EWS)

⦁ Middle Income Group – I

⦁ Middle Income Group – II

Subsidy amount never do any adjustment keeping in brain tenure. The influence made to subsidy amount can be adjusted keeping in brain the principal amount only. Such a matter further affect the EMI amount that you have to pay every month.

Q. Can he be qualified for the Credit Linked Subsidy Scheme(CLSS) in case the applicant’s wife owns a pucca home on her name, and the applicant wishes to buy his first house under his wife’s name?

Under such situation, not only will the wife is not permitted to qualify for the credit linked subsidy scheme, but the household will not be qualified for it as one of the members in the immediate beneficiary family already owns a pucca home in the nation.

Q. In case a family owner has a plot to his name but not a home, will he be accepted for the subsidy scheme?

It has been mentioned earlier that no member of the beneficiary family must own a pucca home in the nation if they desire to qualify for the PMAY subsidy scheme. However, a factory, owning land for shops, or even a commercial establishments will not obstruct or affect your status as a first house owner who can avail the subsidy scheme.

Q. What is the eligibility for availing the PMAY?

A. You require to fulfill the following PMAY eligibility in order to apply for the scheme:

⦁ The user should be a citizen of India

⦁ The user should not have a house in his/her name

⦁ The user should not have a house in the name of any family member

⦁ The user should belong to either MIG, EWS, or LIG income group

Q. What is the income criteria to avail the PMAY facility?

⦁ Annual Income up to INR 3 lakhs- Economically Weaker Section (EWS)

⦁ Annual Income up to INR 6 lakhs- Lower Income Group (LIG)

⦁ Mid-Income Group (MIG)

⦁ Annual Income up to INR 18 lakhs (MIG 2)

⦁ Annual Income up to INR 12 lakhs (MIG 1)

Q. What are the documents needed to apply for the PMAY scheme?

A. You require to give the following documents-

⦁ Identity Proof- PAN Card, Voter ID Card, Passport, Aadhar Card, Phone Number etc.

⦁ Income Proof- Business Profit-Loss statements, Latest salary slip, and Bank Statements, etc.

⦁ Address Proof- Ration Card, Telephone Bill, Electricity bill, Driving License, Passport

⦁ Other documents – death certificate of spouse (in case of widows), Relevant caste certificates (in case of SC/ST applicants), and Age Proof (for senior citizens).

Q. What is the maximum tenure of assisting the PMAY subsidy?

A. The PMAY subsidy can be benefited for a maximum time of 20 years.

Q. Can an applicant avail the advantages of the PMAY scheme more than once?

A. Not at all. At the time of applying for a PMAY plan, the user require to submit her/his Aadhar Number as this number do keep reserved in the database and thus block any user to apply for the PMAY plan more than once.

Types of PMAY Schemes

To certain that eligible users in rural zones, as well as cities, can equally profit the facility, the PMAY is split into two primary schemes-

⦁ PMAY- Gramin (for villages and other rural areas)

⦁ PMAY- Urban (for cities and towns)

The Pradhan Mantri Awas Yojana is firstly split up into 4 components

In-Situ Redevelopment

Under the PMAY-U, the government goal is to purchase the land in urban areas that are trespass by slum developments and utilize it to build formal urban residential establishments for the slum dwellers.

The scheme main goal is to upgrade the level of living of people in such regions. Respective authorities do involve the slum dwellers through their association for consultations about the implementation and planning of the redevelopment.

Affordable Housing in Partnership

Under this, the government plans to offer economical housing to the beneficiaries by partnering with the private and public sector. This includes involving various industries from different Union territories and States in the country to work together and plan affordable housing projects for the beneficiaries. To check whether you fall into the beneficiary category or not, you do check your PMAY eligibility at the official website, online.

Credit Linked Subsidy Scheme

CLSS or PMAY’s Credit Linked Subsidy Scheme provides an interest subsidy of 6.5% on home loan. Under the PMAY CLSS, Users do enjoy an extended house loan tenure of 20 years. The PMAY lists a maximum limit of INR.6 lakhs to assist the welfare of the house loan subsidy. Moreover, the net present value on the interest allowance is calculated at a discount rate of 9%.

Enhancement and construction of beneficiary-led house

The beneficiaries who are ineligible for the above-mentioned PMAY schemes can get financial aid from the ‘enhanced and construction of beneficiary-led’. Under this, beneficiaries related to the Economically Weaker Section (EWS) can profit financial help up to INR. 1.5 Lakhs from the Central government. These funds can then be utilized to build new homes or uplift the existing one with basic amenities.

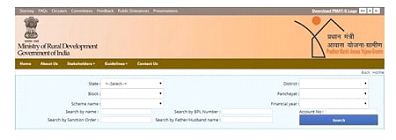

Without Registration Number, How to check your name in PMAY List 2021?

Follow the below-mentioned steps

Step 1: Visit the rhreporting.nic.in official Website:

Directed to https://rhreporting.nic.in/netiay/Benificiary.aspx and then you have to click on the advanced search option.

Step 2: Enter the necessary Information:

You will be redirected to a page that wanted information like your sanction order, BPL number, name, or husband’s or fathers name.

Step 3: Do Click On Search Options:

Enter the essential information and then click on the “search” option.

Step 4: Your Name must visible on the PMAY List 2021:

If your name is present there in PMAY list 2021, the act of searching for your name on the same must yield you results and details related to your profile on the portal.

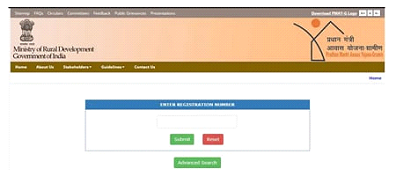

In the PMAY List 2021 (Rural) with a registration number as How to Check your Name?

If your application is accepted under PMAY list 2021 (Grahmin) scheme, you should have received a registration number. Below are a some steps to check your name:

Step 1: Go through the rhreporting.nic.in official Website:

Visit https://rhreporting.nic.in/netiay/Benificiary.aspx through your desktop or cell phone.

Step 2: Do enter Registration Number:

Enter your registration number, and submit.

Step 3: Check Your Name:

Your details must theoretically present as if your registration number is part of the PMAY List 2021 (Rural).

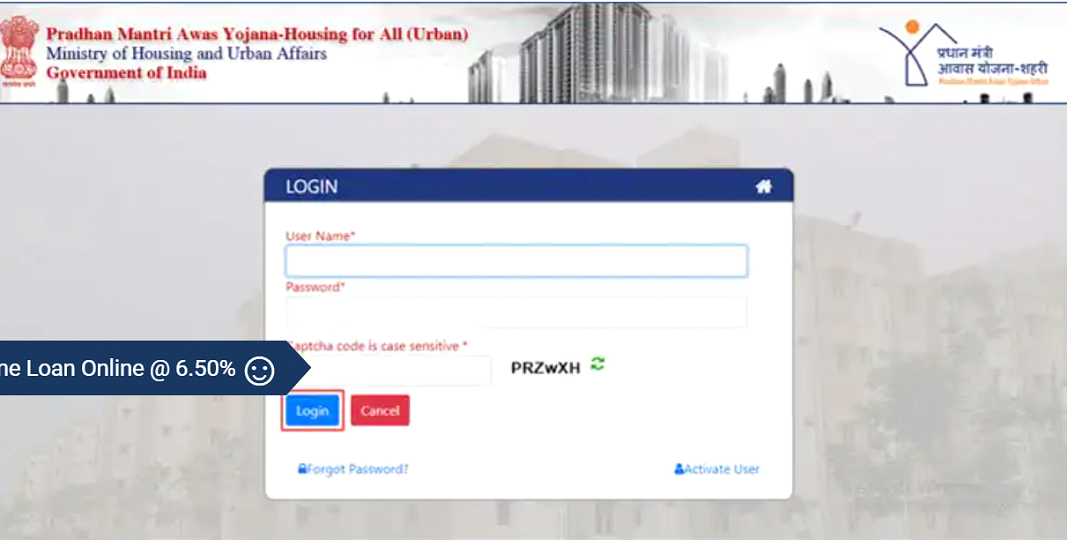

In PMAY list 2021 (Urban) as How to Check out your Name there?

Follow the steps given below-

Step 1: Visit to PMAYMIS GOV IN – Head to https://pmaymis.gov.in/ and then click on the “select beneficiary” option.

Step 2: Select Option – From the drop-down menu, Select the option to search by name.

Step 3: Do Enter First Characters – Enter the initial three characters of your name and click on the “show” option.

Beneficiary Registration Form

| S.No | Yojana | Indira Awas Yojana |

| 1 | Under | Indian Government |

| 2 | Department Name | Ministry of Rural Development |

| 3 | Objective | Financial assistance to the State Government for Rural Development |

| 4 | Benefits | Providing houses to low-income poverty families |

| 5 | Beneficiaries | Citizens of India who are below the poverty line |

| 6 | Official Link | https://pmayg.nic.in/netiay/home.aspx |