Contents

What is start up India scheme?

It is an initiative by the Gov. of India for wealth creation and generation of employment. The aim of Startup India is the innovation and development of services and products and increase the employment structure in the nation. Startup India was set up by PM.

|

Startup India’s 19-Point Action Plan 1. Self-certification Compliance 2. Single Center of Contact via Startup India Hub 3. Simplify Processes with Portal and Mobile App 4. 80% reduction in patent registration fee, Legal Support, and Fast Tracking 5. Relaxed Norms of Public Procurement 6. Faster and Easier Exit 7. Fund Support via a Fund of Funds corpus of INR 10,000 crore 8. Credit Guarantee Funding 9. Tax Exemption on Capital gains 10. 3-Year Income Tax Exemption 11. Tax Exemption on Investments above FMV 12. Annual Startup Fests (international and national) 13. Launch of World-class Innovation Hubs under AIM 14. Set up of nation-wide Incubator Network 15. Innovation Centres to R&D and augment Incubation 16. Research Parks to propel innovation 17. Encourage Entrepreneurship in Biotechnology 18. Innovation Focused Programs for Students 19. Annual Incubator Grand Challenge |

|

Definition of a Startup (for the purpose of Gov. Yojana only) A Startup means an entity: incorporated or registered in the country not prior to five years with an annual turnover not exceeding hundred crore in any preceding financial year work towards development, innovation, and commercialization of newer products, services or processes driven by intellectual or technology property The entity do end up to be a Startup if:- it is set up by splitting up, or reconstruction, of a business already in existence its turnover for the past financial years has exceeded INR 25 crore it has completed 5 years from the date of registration/incorporation Further, the Startup will be eligible for tax benefits only after it has getting certification from the Inter-Ministerial Board, establish for such purpose. |

Conditions for recognition as a ‘Start-up’

under the Startup India as to get recognised as a Start-up, a business entity should full fill the given conditions:

- The business should be registered as a

- undergoing Companies Act, 2013, Private Limited Company

- undergoing the Limited Liability Partnership Act, 2008, Limited Liability Partnership

- Undergoing the Partnership Act, 1932, Partnership Firm

- The turnover of business for any of the financial years since registration/incorporation has not exceeded Rupees 25 crores

- The Business is working towards improvement, innovation, and development of products or services or processes, or if it is a scalable business model with a higher potential of wealth creation and employment generation

Definition of “Startup”

Any organization which get into given list of category will be denoted as Startup and permitted to be identify by the DPIIT to avail the gain from the Indian Gov.

- Age of the Organization – The Date of Incorporation must not exceed 10 years

- Type of Organization – Must have been Incorporated as a Private Limited Company or a Registered Partnership Firm or a Limited Liability Partnership

- Annual Turnover – since its Incorporation, must not exceed Rs.100 crore for any of the financial years

- Original Entity – The organization or Entity must have been formed originally by the promoters and must not have been formed by splitting up or reconstructing an existing business

- Innovative & Scalable – Must have plan for improvement and development of a product, process or service and/or have a scalable business model with higher potential for the forming of wealth & employment

Benefits from DPIIT

Under the Startup India Initiative, the organizations which are registered under DPIIT are eligible to get the following profits:

Handholding and Simplification– Easier compliance, easy way exit method for break down startups, legal support, fast-tracking of a website to lessen information asymmetry and patent applications.

Funding & Incentives – Exemptions on Capital Gains Tax and Income Tax for eligible startups; a fund of funds to fill more capital into the a credit guarantee scheme and startup ecosystem.

Incubation & Industry-Academia Partnerships – Formation of many events, incubators and innovation labs, grants and competitions.

Procedure of Recognition as a Start-up

- Register the business as a Partnership Firm/Private Limited Company / Limited Liability Partnership

- Acquire PAN for the Business

- Acquire MSME Registration for the Business

- Make a tiny writeup on the given matter:

- What is the issue the startup is solving?

- How does the startup propose to solve this issue?

- What is the distinctiveness of solution by the startup?

- How does the startup develop revenue?

- Details of any recognition/awards received by the startup

- File application at www.startupindia.gov.in with supportive documents like Certificate of Registration/Incorporation

Start-Up India Hub will review the application and if the application attain the Start-up India conditions and guidelines, will issuing the Certificate of Recognition and will allow recognition as a Startup.

Advantages for recognised ‘Start-up’

Asper the rules of DIPP, a recognised start-up gets the following profits:

- Self-Certification: under environmental & labour laws for Compliance

- Tax Exemption: exemptions on capital gains and investments above Fair Market Value and Income Tax exemption for a timeline of 3 consecutive years.

- Easy winding up of organization: under insolvency and Bankruptcy code 2016 within 90 days.

- Startup IPR protection and Patent Application: Fast track and up to 80% rebate in filling patents.

- Easy Public Procurement Norms: minimum requirements and Exemption on EMD . Get listed as a seller

- SIDBI Fund of Funds: through Alternate Investment Funds as Funds for investment into startups.

Who is entitled for startup India?

Eligibility is a a limited liability partnership or private limited company or registered as a partnership firm. Has an yearly turnover not exceeding Rs. 100 crore for any of the financial years since registration/incorporation.

Which one of the registration is best for startup?

A new business should get incorporated in any of these business pattern as per the scale of its number of members, operations, capital invested, and the risk connected with the business.

Do startups require to be registered?

In India, The Startup registration process has been simplified. After an entity is permitted to be recognized as a Start-up, it requires to register itself on the Startup India portal. After filling the form of registration, the entity should attach a letter of recommendation.

How To Register A Startup In India – Legal Requirements and Procedure

An incubator (located in a post-graduate college) attesting to the fresh module of the business.

Alternatively, the letter of recommendation could be given by an incubator that has been recognized or funded by the Indian gov. in the format given by DIPP.

A letter of recommendation from either the central or state government.

Under the Startup India Initiative, Can a One Person Company (OPC) enjoy the incentives?

Yes

What is the timeline of getting a Startup recognition certificate?

When an application is made along with all the pre-requisite certificates then approval will be received within a timeline of two working days.

Under with Startup India initiative, Can a foreigner be registered?

Under the LLP Act, a foreign individual do registered.

Realistic Manners To Fund Your Startup

Friends and Family

Borrow money from family and friends is a great manner to start a business. While it may be tougher to convince investors or banks of the quality of your pattern, your family and friends often faith in your dream.

Small Business Loans

Some banks especially provide loans to small businesses, but banks historically are pretty careful about giving cash to tiny companies. It can be tough to qualify. There are another lending organizations, however, who might be fair one equipped to support you get your business off the ground.

Eligibility For Startup Registration

- The organization to be formed should be a private limited organization or a limited liability partnership.

- The firms must have getting the approval from DIPP.

- To get approval from the Department of Industrial Policy and Promotion, the firm must be funded by an Private Equity Fund, Incubation fund, and Angel Fund.

- The firm must have getting a patron guarantee from the Indian patent and Trademark Office.

- under the start-up India campaign, Capital gain is exempted from income tax.

- The firm should offer innovative products or schemes.

- Angel network, Accelerators, Angel fund, Incubation fund, and Private Equity Fund should be registered with SEBI.

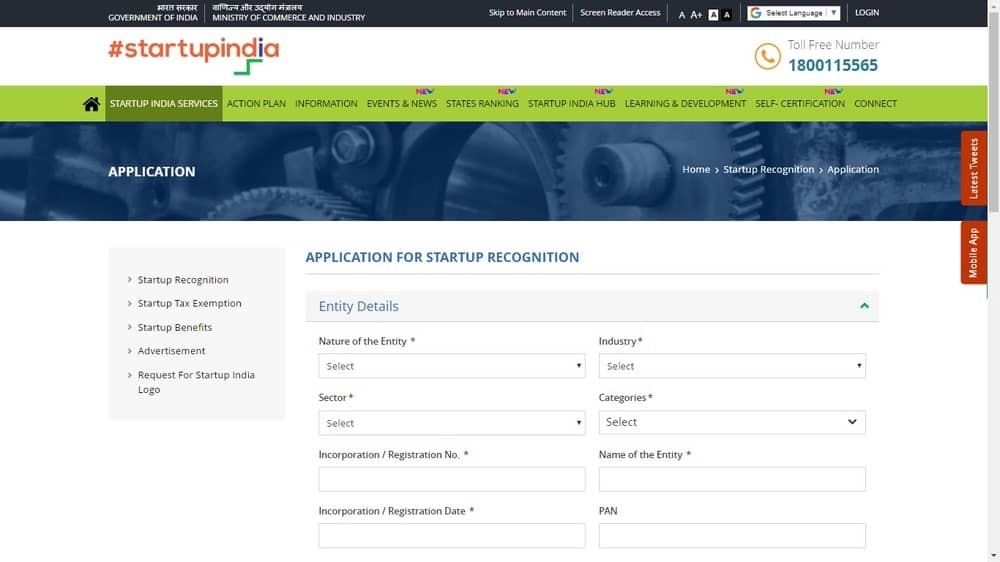

Application Procedure

Step 1 –Go through the Startup India Portal https://startupindia.gov.in/registration.php

Step 2: Do enter your Legal Entity.

Step 3 : Do Enter your Registration No./Incorporation.

Step 4 : Do Enter your Registration/Incorporation Date.

Step 5: Do Enter the PAN Number (optional).

Step 6: Do Enter your State, address, and Pin Code.

Step 7: Do Enter details of the Authorised Representative.

Step 8: Do Enter the Details of Partners and Directors.

Step 9: Upload the necessary Self-certification and documents in the prescribed manner.

Step 10: File the Registration/Incorporation certificate of the organization.